📌 Table of Contents (Click to Navigate)

- Introduction

- Who is Senator Cynthia Lummis?

- Background: U.S. Crypto Taxation Landscape

- The Lummis Bill: Breaking Down the Details

- Why the \$300 Threshold Matters

- How Crypto Taxes Currently Work

- Examples of Daily Crypto Transactions

- The Problem with Micropayment Taxation

- How Other Countries Handle Crypto Taxes

- The Economic Impact of the Bill

- How It Will Affect Users, Businesses, and Developers

- The Role of Stablecoins

- Why Bitcoin Maximalists Support the Bill

- What Critics Are Saying

- Political Support and Bipartisanship

- Lobbying and Advocacy Groups Involved

- Web3, NFTs, and the Future of Tax-Exempt Innovation

- The Role of Lightning Network and Layer 2

- What This Means for Financial Freedom

- Regulatory Hurdles

- Crypto Privacy and Compliance Implications

- IRS, Enforcement, and Monitoring

- Could This Open the Door for Broader Reforms?

- How to Track Your Transactions Under the New Law

- Wallet Providers and Software Implications

- Opportunities for Retail Adoption

- Crypto Startups and Venture Capital Perspective

- Potential for International Influence

- State vs. Federal Tax Treatment

- What Could Go Wrong? Risks to Watch

- Citizen Reaction and Grassroots Movements

- Could Crypto Be Treated Like Cash?

- AI and Blockchain Synergies with Micropayments

- CBDCs vs. Decentralized Crypto Post-Bill

- Final Words: A Paradigm Shift in Motion

1. Introduction

In a move that could dramatically reshape the American crypto landscape, Senator Cynthia Lummis has introduced a bill that would exempt crypto transactions under \$300 from taxation. For crypto enthusiasts and casual users alike, this could represent the single most significant advancement in day-to-day usability for digital assets.

With the IRS traditionally treating crypto as property and taxing every use of it—even buying a \$2 coffee—this bill could finally unlock crypto’s true potential as a medium of exchange, not just a speculative asset.

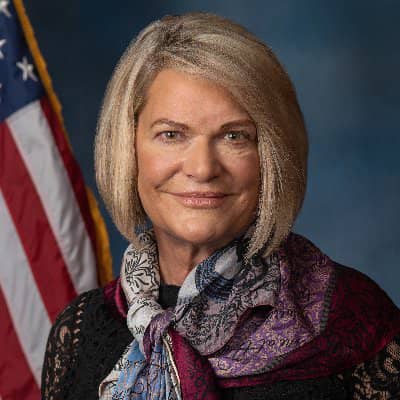

2. Who is Senator Cynthia Lummis?

Senator Lummis represents Wyoming—a state known for its crypto-friendly regulations. She’s not just a politician talking about digital currency; she personally owns Bitcoin and has introduced multiple pieces of legislation aimed at providing clarity and support to the Web3 industry.

She believes in:

- Decentralization

- Financial privacy

- Limited government oversight over personal transactions

This bill is the latest in her ongoing efforts to modernize the American financial system.

3. Background: U.S. Crypto Taxation Landscape

Crypto is currently taxed as property under IRS guidelines. That means every sale, swap, or use is a taxable event—even if the transaction value is only \$5.

This creates:

- Heavy burdens for users

- Inhibitions against daily use

- Reliance on crypto as an investment only

For years, crypto advocates have pushed for changes—especially around microtransactions and daily spending.

4. The Lummis Bill: Breaking Down the Details

The Lummis bill is simple in language but powerful in impact:

- No capital gains tax on crypto transactions under \$300

- Applies to personal use, not business or investment

- Aims to align crypto use with cash and digital payments

There’s also talk of adjusting the \$300 limit for inflation annually.

5. Why the \$300 Threshold Matters

This number wasn’t pulled out of thin air—it was chosen to:

- Cover most retail-level spending

- Enable online and in-person payments

- Avoid abuse by large-scale investors

A \$300 limit allows:

- Buying concert tickets

- Paying for dinner

- Making streaming subscriptions

- Purchasing goods online

It removes the tax burden from life’s routine purchases.

6. How Crypto Taxes Currently Work

Example:

You buy 0.05 BTC for \$1,500. Two years later, you use 0.01 BTC to buy a laptop worth \$900. At the time of purchase, BTC is worth \$90,000.

You’d owe capital gains on:

- \$900 – \$300 (your cost basis) = \$600 gain

- Capital gains tax: potentially 15–20% of that

With Lummis’ bill, this tax would be zero.

7. Examples of Daily Crypto Transactions

Here’s where this bill gets exciting:

- Buying lunch from a food truck using USDC

- Streaming payments to creators via Lightning Network

- Sending your friend \$50 in ETH to split a bill

- Buying a game or in-game NFT skin worth \$80

Previously, each of these required manual tracking. Now, they may be tax-free.

8. The Problem with Micropayment Taxation

Crypto was never meant to be a “buy and hold” asset only. It was designed to be:

- Spent

- Shared

- Tipped

- Traded

But current laws made it too complicated. For instance:

- Would you report a \$1 gain on a \$7 cappuccino paid with DOGE?

- How would IRS even track that?

The bill removes this friction.

9. How Other Countries Handle Crypto Taxes

Many countries are already ahead of the U.S. in treating crypto fairly:

- Germany: Crypto held over 1 year = tax-free

- Portugal: Crypto income from individuals = tax-free

- Singapore: No capital gains tax

- UK: Simplified rules for small trades

The U.S. risks falling behind without reform.

10. The Economic Impact of the Bill

This could unleash a massive wave of crypto commerce:

- Small businesses accepting BTC

- Creators monetizing directly in ETH

- Tipping, donations, peer-to-peer services

- Artists and musicians creating tokenized work

The velocity of money in crypto ecosystems could explode.

11. How It Will Affect Users, Businesses, and Developers

For Users:

- More incentive to use crypto for payments

- Less fear of triggering IRS audits

- Simpler recordkeeping

For Businesses:

- Easier to accept crypto without complicating tax reporting

- Reduced need for automated capital gains calculations

- Improved customer experience

For Developers:

- Opportunity to build lightweight crypto apps

- Seamless integrations with POS systems

- Decentralized commerce becomes practical

12. The Role of Stablecoins

Stablecoins like USDC and USDT may benefit the most.

- No volatility = no surprise gains/losses

- Perfect for day-to-day use

- Could make stablecoins the default currency for micropayments in the U.S.

13. Why Bitcoin Maximalists Support the Bill

Bitcoiners believe BTC should function as:

- Store of value

- Medium of exchange

This bill:

- Pushes adoption

- Encourages Lightning Network use

- Aligns with Satoshi’s vision

14. What Critics Are Saying

Not everyone is thrilled.

Critics argue:

- It could be hard to enforce

- Creates loopholes for tax avoidance

- May only benefit the crypto-wealthy

- It complicates IRS auditing capabilities

Some fear mass abuse of the under-\$300 rule.

15. Political Support and Bipartisanship

Senator Lummis has been known to work across the aisle, especially with:

- Senator Kirsten Gillibrand (D-NY)

- Senator Ted Cruz (R-TX)

- Congressman Tom Emmer (R-MN)

This bill may attract bipartisan attention due to:

- Financial freedom appeal

- Technological innovation

- Growing young voter demand

16. Lobbying and Advocacy Groups Involved

Key players backing this bill include:

- Coin Center

- Blockchain Association

- Chamber of Digital Commerce

- Bitcoin Policy Institute

- Stand With Crypto Alliance

These groups are ramping up lobbying efforts in Washington.

17. Web3, NFTs, and the Future of Tax-Exempt Innovation

If NFTs are used in microtransactions (e.g., metaverse clothing, game skins), this bill may:

- Eliminate taxation on small-scale digital asset purchases

- Drive adoption in gaming and entertainment

- Benefit creators and marketplaces like OpenSea, Magic Eden, and Zora

18. The Role of Lightning Network and Layer 2

The Lightning Network, Arbitrum, Optimism, and other Layer 2s:

- Make fast, cheap transactions viable

- Are perfect for payments under \$300

- Could now be used without a tax headache

19. What This Means for Financial Freedom

Crypto aligns with:

- Permissionless money

- Anti-censorship transactions

- Self-sovereign finance

Taxing every \$1 transaction goes against this. Removing that burden opens up:

- Charitable donations

- Tipping

- Microloans

- Freelance gigs

20. Regulatory Hurdles

Challenges ahead include:

- IRS resistance

- Treasury Department concerns

- Pressure from legacy banking lobbies

- Political posturing during election cycles

The bill needs committee approval, Senate vote, and House alignment.

21. Crypto Privacy and Compliance Implications

If the IRS doesn’t require reporting for under-\$300:

- It could reduce surveillance

- Could increase private, anonymous payments

- But may lead to new compliance software for wallets

Some worry it’s a backdoor to mass KYC instead.

22. IRS, Enforcement, and Monitoring

Questions remain:

- How will IRS verify if a \$299 transaction had a gain?

- Will crypto wallets need to generate receipts?

- Can blockchain analytics handle this scale?

23. Could This Open the Door for Broader Reforms?

Absolutely.

If this bill passes, it could lead to:

- Higher thresholds (\$600?)

- Annual crypto tax holidays

- Flat tax systems for DeFi earnings

- Simplified tax brackets for on-chain income

24. How to Track Your Transactions Under the New Law

Expect wallet providers to:

- Auto-flag eligible tax-exempt transactions

- Generate tax summaries

- Provide CSV exports for accountants

Platforms like CoinTracker, Koinly, and ZenLedger will adapt fast.

25. Wallet Providers and Software Implications

Wallet apps may add:

- “Tax-free mode”

- Indicators for exempt vs. taxable spends

- Automated cost-basis adjustments

This will make crypto UX significantly easier for the average person.

26. Opportunities for Retail Adoption

Starbucks, Target, Spotify—any platform could now:

- Accept crypto without complex accounting

- Offer crypto payments at checkout

- Use stablecoins to hedge volatility

27. Crypto Startups and Venture Capital Perspective

VCs and startups are excited.

New use cases:

- Crypto POS systems

- Shopping apps with crypto loyalty rewards

- Decentralized finance credit cards

- Tipbots for creators and streamers

Expect a funding boom if this passes.

28. Potential for International Influence

Other countries may follow suit.

Possible domino effect:

- Canada

- Australia

- UK

- Mexico

- Philippines

Crypto regulation is increasingly borderless.

29. State vs. Federal Tax Treatment

Even if federal capital gains are exempt, states like:

- California

- New York

- Illinois

…may still want a piece. Expect state-level lobbying to align laws.

30. What Could Go Wrong? Risks to Watch

- Abuse by whales doing rapid \$299.99 trades

- Poor enforcement tools

- Massive IRS backlog

- Confusion around transaction reporting

- Political reversal if a new administration disagrees

31. Citizen Reaction and Grassroots Movements

Crypto Twitter is buzzing.

Hashtags like #TaxFreeCrypto and #LummisBill are trending.

Grassroots groups like:

- Bitcoiners for Freedom

- CryptoPAC

- HODL Lobby

…are organizing town halls and calls to action.

32. Could Crypto Be Treated Like Cash?

That’s the goal.

If you can:

- Tip your waiter

- Buy gum

- Send \$20 to your kid

…without tax complexity, crypto truly becomes cash-like in utility.

33. AI and Blockchain Synergies with Micropayments

AI services often need:

- Micro-access

- Streaming pay-per-query billing

This law enables:

- AI APIs charging per use in crypto

- Secure data exchange over chain

- Crypto-native AI bots

A whole new frontier opens.

34. CBDCs vs. Decentralized Crypto Post-Bill

CBDCs (central bank digital currencies) are being explored by the Fed. But:

- Will they offer similar tax relief?

- Or will they control spending?

This bill strengthens the decentralized alternative to government money.

35. Final Words: A Paradigm Shift in Motion

Senator Lummis’ bill is more than a tax exemption.

It’s a philosophical statement:

- Crypto is a legitimate currency

- Citizens deserve financial freedom

- Innovation shouldn’t be stifled by outdated tax codes

If passed, this bill could mark the beginning of a new economic era in America—where crypto finally becomes spendable, scalable, and simple.