WHAT IS LOT SIZE IN FOREX ?

🟢 First, Imagine you are buying rice at the market. You don’t buy rice grain by grain.You buy a bag of rice. That “bag” is like a lot in Forex.

Okay 👍 let’s keep it very simple,

In Forex, a lot is just the size of your trade

⚡PRACTICAL EXAMPLE

If you buy 1 lot of EUR/USD, it means you are buying a certain amount of euros against dollars.

Think of it like buying in bulk:

1.00 lot = 100,000 units (big trade)

0.10 lot = 10,000 units (medium trade)

0.01 lot = 1,000 units (small trade)

👉 In short:

Lot in Forex Trading = how big or small your order is in the Forex market.

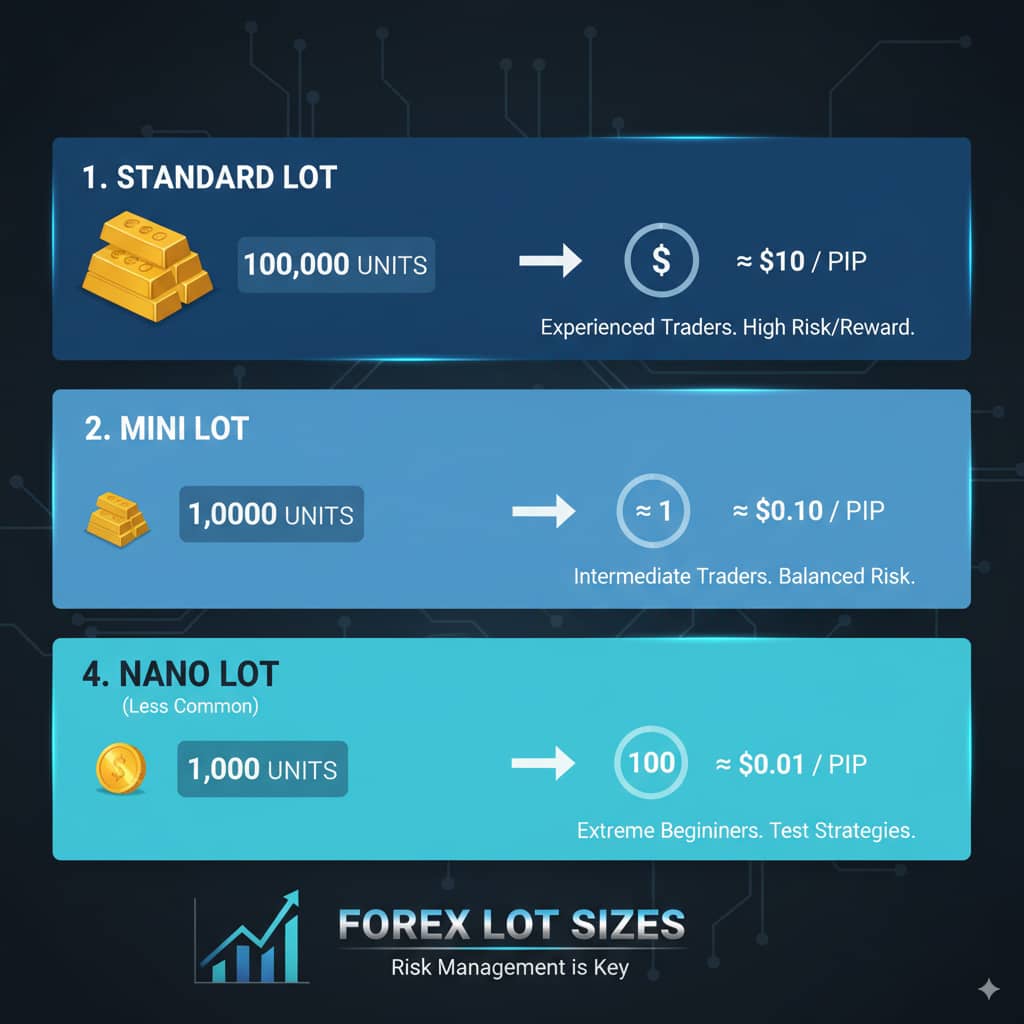

TYPES OF LOT IN FOREX MARKET

Types of Lots in Forex Trading

In Forex trading, a “lot” refers to a unit of measurement for the size of a trade. Understanding lot sizes is crucial because they directly impact your risk exposure and potential profits or losses. Here are the main types of lots in Forex trading:

1. Standard Lot:

- A standard lot is equal to 100,000 units of the base currency.

- For most currency pairs, a one-pip movement in a standard lot trade is typically worth $10.

- Standard lots are often used by more experienced traders or those with larger trading accounts, as they involve higher risk and potential returns.

2. Mini Lot:

- A mini lot is one-tenth the size of a standard lot, meaning it’s 10,000 units of the base currency.

- A one-pip movement in a mini lot trade is generally worth $1.

- Mini lots are a good option for traders who are moving beyond micro lots but still want to manage risk more conservatively than with standard lots.

3. Micro Lot:

- A micro lot is one-tenth the size of a mini lot, or one-hundredth of a standard lot, representing 1,000 units of the base currency.

- A one-pip movement in a micro lot trade is typically worth $0.10.

- Micro lots are ideal for beginner traders who are just starting out, or for those with smaller trading accounts, as they allow for very small risk exposure per trade.

4. Nano Lot (Less Common):

- While less common than the other three, some brokers offer nano lots, which are 100 units of the base currency.

- A one-pip movement in a nano lot trade would be worth $0.01.

- These are primarily used for extreme beginners or for testing strategies with minimal capital.

Here’s a quick summary table:

| Lot Type | Units of Base Currency | Approximate Value Per Pip (for USD pairs) |

|---|---|---|

| Standard Lot | 100,000 | $10 |

| Mini Lot | 10,000 | $1 |

| Micro Lot | 1,000 | $0.10 |

| Nano Lot | 100 | $0.01 |

Choosing the right lot size is a critical part of your risk management strategy. It should align with your account balance, risk tolerance, and trading strategy.

In Forex, you don’t trade one dollar or one euro at a time. You trade in lots (fixed sizes).

WHAT IS A PIP ?

A pip is the smallest unit of price movement in Forex.

Note: For EUR/USD and GBP/USD → 1 pip = 0.0001 change in price.

👉 Example:

EUR/USD = 1.1000

If EUR/USD price moves to 1.1001, that’s 1 pip move.

🟢 3. How Pip Value Works with Lot Size

The money value of each pip depends on your lot size.

For EUR/USD or GBP/USD:

1.00 lot (100,000 units) → 1 pip ≈ $10

0.10 lot (10,000 units) → 1 pip ≈ $1

0.01 lot (1,000 units) → 1 pip ≈ $0.10

Real Example with EUR/USD

Let’s say EUR/USD = 1.1000.

You buy 0.01 lot (1,000 units).

Price moves from 1.1000 → 1.1010 (that’s 10 pips).

With 0.01 lot, each pip = $0.10 → so 10 pips = $1 profit.

👉 If you used 0.02 lot, each pip = $0.20 → so 10 pips = $2 profit.

👉 If you used 0.03 lot, each pip = $0.30 → so 10 pips = $3 profit.

🟢 Why This Matters

Bigger lot = bigger gains and bigger losses per pip.

Smaller lot = smaller risk, safer for beginners.

✅ So in real sense:

Lot = the size of your trade (how much currency you are controlling).

Lot size = how big or small your trade is (standard, mini, micro).

Pip = the smallest step the price moves (0.0001 for EUR/USD, GBP/USD).

Pip value = how much money you win/lose per pip, which depends on your lot size.

🔥🔥🔥EXPLAIN EVERYTHING SINGLE WORD AND NUMBER THE CALCULATION AND HOW THEY ARE GOTTEN.

FX (EURUSD, GBPUSD): 1.00 lot = 100,000 units; 1 pip = 0.0001; ≈ $10 per pip for 1.00 lot → so

0.01 lot ≈ $0.10/pip, 0.02 lot ≈ $0.20/pip, 0.03 lot ≈ $0.30/pip.

Glossary (word-by-word)

FX — short for Foreign Exchange (also called Forex). It means the market where people buy and sell one currency for another (e.g., euros for dollars).

2.) EURUSD — a currency pair.

EUR = the base currency (euros).

USD = the quote currency (US dollars).

The pair means: “how many US dollars for 1 euro.”

3.) GBPUSD — another currency pair.

GBP = British pound (base).

USD = US dollar (quote).

Means: “how many US dollars for 1 pound.”

4.) 1.00 lot — the way forex quotes trade size. 1.00 lot = 100,000 units of the base currency.

If you open 1.00 lot of EURUSD, you are trading 100,000 euros.

5.) units — single units of the base currency. For EURUSD the unit = 1 euro. So 100,000 units = 100,000 euros.

6.) 1 pip — the smallest normal price step the pair moves.

For EURUSD and GBPUSD, 1 pip = 0.0001 (this is the usual convention).

7.) 0.0001 — decimal number representing the pip size. If EURUSD price goes from 1.1000 → 1.1001, that change is 0.0001, i.e., 1 pip.

8.) ≈ $10 per pip for 1.00 lot — this says that when you trade 1.00 lot (100,000 units), each 1 pip move equals about $10 (because USD is the quote currency). I will prove this exactly below.

0.01 lot ≈ $0.10/pip — a tiny trade (0.01 lot) equals 1,000 units, so each pip ≈ $0.10. I’ll show the calculation.

0.02 lot ≈ $0.20/pip — same idea: 0.02 lot = 2,000 units → each pip ≈ $0.20.

0.03 lot ≈ $0.30/pip — 0.03 lot = 3,000 units → each pip ≈ $0.30.

🔥🔥🔥Exact calculations (numbered, step-by-step, digit-by-digit)

A — Conversion: lot → units

1.) Definition: 1.00 lot = 100,000 units.

2) Formula: units = lot × 100,000.

For 1.00 lot:

units = 1.00 × 100,000

Multiply digit-by-digit:

1.00 × 100000 = 100000 → 100,000 units.

For 0.01 lot:

units = 0.01 × 100,000

Compute: 0.01 × 100000 = 0.01 × 100000 = 100000 × 1/100 = 1000 → 1,000 units.

For 0.02 lot:

units = 0.02 × 100,000 = 0.02 × 100000 = 100000 × 2/100 = 2000 → 2,000 units.

For 0.03 lot:

units = 0.03 × 100,000 = 100000 × 3/100 = 3000 → 3,000 units.

B — What is the pip size (decimal)

3.) For EURUSD/GBPUSD: 1 pip = 0.0001.

Example: 1.1000 → 1.1001 is 0.0001 difference = 1 pip.

C — How to get $ per pip (basic formula)

4.)Example: Formula (for USD-quoted pair):

pip value in USD = pip size × units

Reason: Each unit of base currency changes the quote currency by pip size. If each unit moves 0.0001 USD, then units × 0.0001 = total USD change per pip.

D — Apply formula to each lot size (digit-by-digit)

5.)Example 1.00 lot (100,000 units):

pip value = pip size × units = 0.0001 × 100000

Compute carefully: 0.0001 × 100000 = 100000 × 1/10000 (because 0.0001 = 1/10,000)

→ 100000 / 10000 = 10

So pip value = 10 USD → $10 per pip.

That is why we say 1.00 lot ≈ $10 per pip (for USD-quoted pairs).

6) Example 0.01 lot (1,000 units):

pip value = 0.0001 × 1000

1000 × 1/10000 = 1000 / 10000 = 0.1

So pip value = 0.1 USD = $0.10 per pip.

7.) 0.02 lot (2,000 units):

pip value = 0.0001 × 2000

2000 / 10000 = 0.2

So pip value = 0.2 USD = $0.20 per pip.

8.) Example: 0.03 lot (3,000 units):

pip value = 0.0001 × 3000

3000 / 10000 = 0.3

So pip value = 0.3 USD = $0.30 per pip.

(These are exact, not guesses — because for USD-quoted pairs pip size × units gives USD directly.)

E — Short, useful derived formula

9.) EXAMPLE: Combine steps: pip value = 0.0001 × (lot × 100000)

Simplify: pip value = 0.0001 × 100000 × lot = 10 × lot

So pip value (USD) = 10 × lot for EURUSD/GBPUSD.

If lot = 1.00 → 10 × 1.00 = $10.

If lot = 0.01 → 10 × 0.01 = $0.10.

If lot = 0.02 → 10 × 0.02 = $0.20, etc.

F — Example: money made/lost for a price move

10.) Example: You open 0.02 lot of EURUSD. Price moves 25 pips in your favor. How much do you make?

pip value = 10 × lot = 10 × 0.02 = 0.20 USD per pip

Profit = pip value × pips = 0.20 × 25

Compute: 0.20 × 25 = (20 cents) × 25 = 500 cents = $5.00

So you make $5.00.

11.) Example: You open 1.00 lot and price moves 10 pips:

pip value = 10 × 1.00 = $10

Profit = $10 × 10 pips = $100

Notes & small caveats (so you understand when the number might change)

The calculations above are exact for pairs where the quote currency is USD (EURUSD, GBPUSD) and your account currency is USD.

If your account currency is not USD, or the pair is not USD-quoted, you may need an extra conversion step.

Some brokers display prices with an extra digit (5 decimal places, fractional pips); the pip definitions and math still work but watch how your broker defines a pip.

Final one-line summary (no math)

Lot = how big your trade is (1.00 lot = 100,000 units).

Pip = the smallest usual move (0.0001 for EURUSD/GBPUSD).

Why $10/pip for 1.00 lot? Because 0.0001 × 100,000 = 10, so one tiny move (1 pip) times the 100,000 units you control equals $10.

🔥🔥🔥🟢 4. The Relationship Between Lot, pip and leverage

🟢 1. Lot Size = How Big Your Trade Is

Lot size tells you how many units of currency you are trading.

1.00 lot = 100,000 units

0.10 lot = 10,000 units

0.01 lot = 1,000 units

👉 Lot size controls the pip value (how much each price movement is worth in money).

🟢 2. Pip = The Price Movement

A pip is the smallest movement in Forex.

EUR/USD: 1 pip = 0.0001

GBP/USD: 1 pip = 0.0001

👉 Pip tells you how much the market moved.

🟢 3. Leverage = Borrowing Power

You don’t need the full trade money yourself.

Leverage lets you control big money with small deposit.

👉 Example:

You trade 1.00 lot of EUR/USD = $100,000 value.

With 1:100 leverage, you only need $1,000 margin (100,000 ÷ 100).

With 1:500 leverage, you only need $200 margin (100,000 ÷ 500).

So leverage reduces the money you need to open the trade.

🟢 4. The Relationship Between Them

Think of them like a car 🚗:

Lot size = Engine size (big engine = more speed/power = more risk & reward).

Pip = Distance you drive (how far the car moves).

Leverage = Fuel booster (lets you drive a big car with a small tank of gas).

🟢 5. Real Calculation Example (EUR/USD)

Let’s combine them.

Case 1:

Lot size = 0.10 (10,000 units)

Leverage = 1:100

Price moves = 10 pips

Step by step:

1 pip value for 0.10 lot = $1 (since 1.00 lot = $10 → divide by 10).

Price moved 10 pips → 10 × $1 = $10 profit/loss.

Trade value = $10,000.

With 1:100 leverage → margin needed = 10,000 ÷ 100 = $100.

👉 You only used $100 margin, but you gained/lost $10 from a 10 pip move.

Case 2:

Lot size = 0.01 (1,000 units)

Leverage = 1:500

Price moves = 100 pips

Step by step:

1 pip value for 0.01 lot = $0.10.

Price moved 100 pips → 100 × $0.10 = $10 profit/loss.

Trade value = $1,000.

With 1:500 leverage → margin needed = 1,000 ÷ 500 = $2.

👉 You only used $2 margin, but you gained/lost $10 from a 100 pip move.

🟢 6. The Core Relationship

Lot size decides pip value (big lot = big money per pip).

Pip is the actual movement (how far the market went).

Leverage reduces required capital (lets you trade big with little money).

But ⚠: Leverage doesn’t change profit per pip — it only changes how much margin you need.

✅ So in one line:

Profit/Loss = Lot size × Pip movement × Pip value

Margin = Trade size ÷ Leverage